7 Easy Facts About Personal Loans copyright Explained

7 Easy Facts About Personal Loans copyright Explained

Blog Article

Indicators on Personal Loans copyright You Should Know

Table of ContentsThe Main Principles Of Personal Loans copyright 9 Easy Facts About Personal Loans copyright DescribedThe Basic Principles Of Personal Loans copyright Everything about Personal Loans copyrightSome Known Details About Personal Loans copyright

Doing a regular budget will provide you the confidence you need to manage your money efficiently. Excellent points come to those that wait.Saving up for the huge points implies you're not going into financial debt for them. And you aren't paying more in the lengthy run due to all that passion. Trust us, you'll delight in that family members cruise ship or playground set for the kids way more understanding it's currently paid for (as opposed to paying on them till they're off to college).

Absolutely nothing beats tranquility of mind (without debt of course)! You do not have to transform to personal car loans and debt when things get tight. You can be complimentary of financial debt and start making actual traction with your cash.

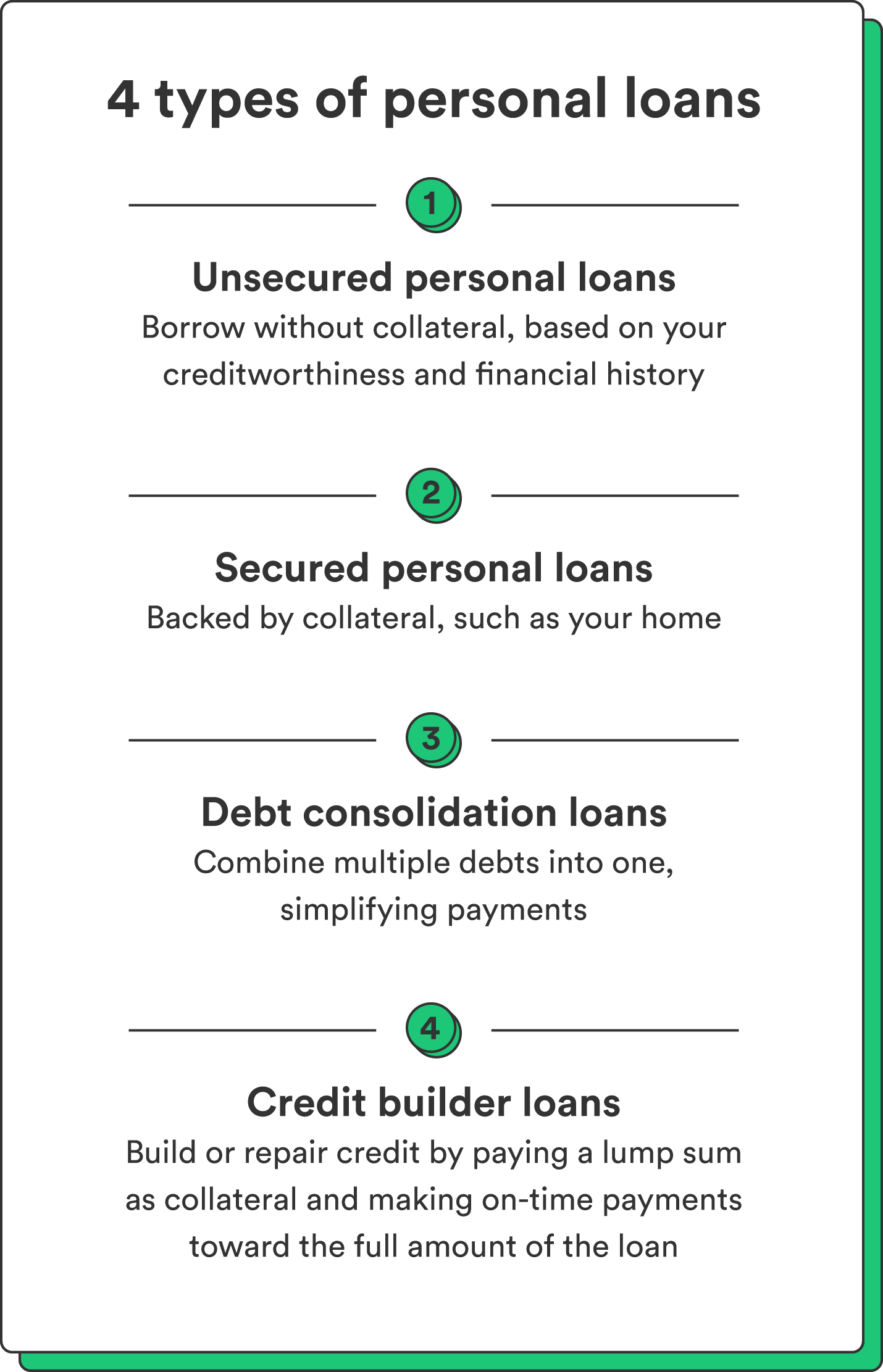

An individual funding is not a line of credit history, as in, it is not revolving funding. When you're authorized for an individual loan, your loan provider gives you the full quantity all at once and then, usually, within a month, you start payment.

Personal Loans copyright Can Be Fun For Anyone

A typical factor is to settle and merge financial debt and pay every one of them off simultaneously with a personal car loan. Some banks put terms on what you can use the funds for, but several do not (they'll still ask on the application). home enhancement loans and restoration car loans, car loans for moving expenditures, trip financings, wedding event lendings, medical car loans, vehicle fixing fundings, financings for rent, little vehicle loan, funeral loans, or various other costs repayments generally.

At Springtime, you can use no matter! The demand for individual car loans is climbing among Canadians interested in escaping the cycle of cash advance finances, combining their financial obligation, and restoring their credit report. If you're obtaining an individual loan, below are some points you ought to maintain in mind. Individual lendings have a set term, which suggests that you recognize when the debt has actually to be paid off and just how much your payment is on a monthly basis.

:max_bytes(150000):strip_icc()/Personal-loans-111715-final-3c39d6d214e44604bdc1efca2525d37d.png)

4 Simple Techniques For Personal Loans copyright

Additionally, you may be able to minimize just how much overall interest you pay, which indicates more money can be conserved. Individual financings are effective tools for building up your credit rating. Settlement background make up 35% of your credit scores score, so the longer you make regular payments promptly the a lot more you will certainly see your rating boost.

Personal loans supply an excellent chance for you to restore your credit scores and repay debt, however if you do not budget plan correctly, you might dig on your own into an also much deeper opening. Missing one of your monthly repayments can have an unfavorable effect on your credit rating yet missing numerous can be ruining.

Be prepared to make every single repayment on schedule. It holds true that an individual financing can be used directory for anything and it's less complicated to obtain authorized than it ever remained in the past. But if you do not have an urgent need the added money, it may not be the best solution for you.

The repaired regular monthly settlement amount on a personal financing depends on just how much you're borrowing, the rate of interest, and the fixed term. Personal Loans copyright. Your rate of interest will depend upon factors like your debt rating and income. Most of the times, individual lending prices are a lot less than credit report cards, however often they can be higher

Indicators on Personal Loans copyright You Need To Know

Advantages include great rate of interest prices, incredibly fast handling and financing times & the privacy you might desire. Not everybody likes strolling right into a financial institution to ask for cash, so if this is a challenging spot for you, or you simply don't have time, looking at on the internet loan providers like Spring is a terrific choice.

That largely depends upon your capacity to settle the quantity & pros and disadvantages exist for you could check here both. Payment sizes for personal financings generally drop within 9, 12, 24, 36, 48, or 60 months. Occasionally longer payment periods are an option, though uncommon. Shorter repayment times have really high monthly repayments yet then it mores than swiftly and you don't shed more money to passion.

Top Guidelines Of Personal Loans copyright

Your rates of interest can be connected to your settlement period also. You may obtain go to website a reduced rates of interest if you fund the car loan over a shorter period. A personal term funding features an agreed upon settlement schedule and a repaired or floating rate of interest rate. With a drifting rates of interest, the passion amount you pay will rise and fall month to month based upon market adjustments.

Report this page